Smart Credit: The Next Wave of Financial Innovation

In the fast-changing world of finance, the notion of smart credit is gaining ground as a transformative approach that could redefine how people and companies safeguard their financial well-being. This piece explores what smart credit means, why it matters, and how it might shape tomorrow’s financial services.

Understanding Smart Credit

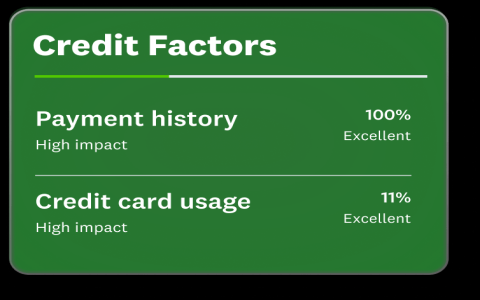

Smart credit refers to modern techniques that evaluate the ability to repay a loan by looking well beyond conventional yardsticks. It taps cutting-edge tools such as artificial intelligence and machine learning to sift through a wider array of signals, producing a sharper picture of credit risk.

What Sets Smart Credit Apart?

Its defining trait is the willingness to weigh non-traditional clues. Classic scoring leans heavily on past borrowing, stated income, and debt ratios, whereas smart credit also notices patterns like digital footprints, app usage, and consistent online habits.

The Impact of Smart Credit on Financial Services

Smart credit is poised to shake up financial services in several key ways.

Expanding Access to Credit

By capturing a fuller portrait of each applicant, smart credit can qualify borrowers who once fell through the cracks, giving more consumers and small businesses a fair chance at affordable financing.

Enhancing Risk Assessment

Richer data streams allow lenders to spot early warning signs and price risk more precisely, leading to healthier loan books and fewer surprise defaults.

Challenges and Concerns

Even so, the road to widespread adoption is not obstacle-free.

Data Privacy and Security

Harvesting deeper personal details raises obvious questions about consent, storage, and protection. Providers must build systems that keep sensitive information safe from breach or misuse.

Algorithmic Bias

If training data reflect historical inequalities, models can unintentionally perpetuate them. Continuous audits and diverse data sets are essential to keep decisions fair and inclusive.

Case Studies and Real-World Applications

Early movers illustrate how smart credit works in practice.

Case Study 1: Peer-to-Peer Lender

One online lending marketplace blends classic bureau scores with indicators like job stability and educational background, approving borrowers who previously would have been turned away.

Case Study 2: AI-Driven Platform

Another fintech start-up feeds billions of anonymized data points into machine-learning engines, uncovering reliable repayment behavior among thin-file customers by analyzing routine mobile and e-commerce activity.

The Future of Smart Credit

As analytics grow ever more sophisticated, expect the following trends:

Increased Adoption

Banks, insurers, and even landlords are likely to embed smart-credit insights into everyday decisions, making the approach mainstream.

Regulatory Framework

Watch for clearer rules on transparency, explainability, and consumer rights, ensuring innovation proceeds without trampling privacy or fairness.

Integration with Blockchain Technology

Pairing smart credit with decentralized ledgers could let individuals share verified financial snapshots instantly, reducing fraud and paperwork.

Conclusion

Smart credit marks a notable leap in financial innovation. By fusing advanced analytics with broader behavioral signals, it promises faster, fairer, and more inclusive lending. Managing data ethics and model bias will determine whether that promise is fully realized, but the destination—an efficient system that serves more people—already looks within reach.

Continued collaboration among technologists, regulators, and consumer advocates will be vital to guide smart credit toward responsible, equitable outcomes for everyone.