The Impact of Fast-Food Catering Prices on the Corporate Catering Market

Introduction

The corporate catering sector has evolved steadily, shaped by multiple forces that steer how providers set their fees. Among these forces, the lunchtime packages offered by large quick-service chains exert notable influence. This article examines how the pricing of such bundled meals affects the broader corporate catering landscape, reviews the elements that shape those prices, and considers what the coming years may hold.

Factors Influencing Fast-Food Catering Lunch Prices

1. Cost of Ingredients

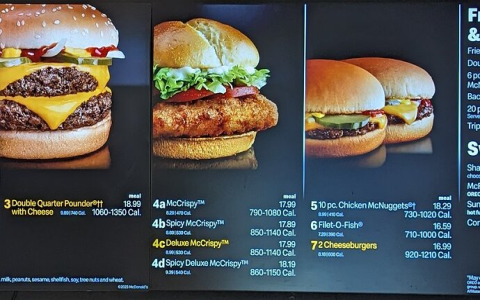

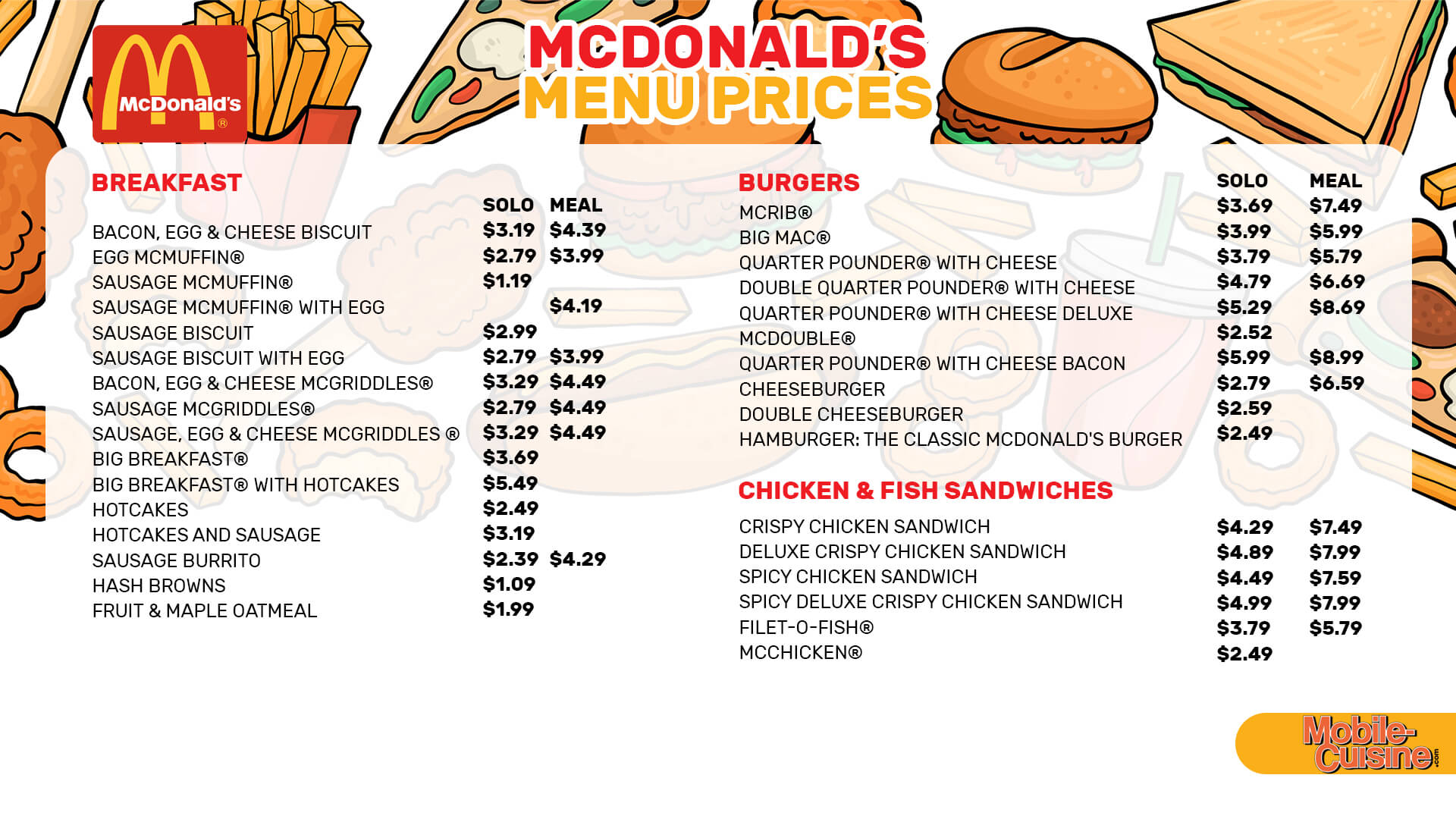

Ingredient expenses remain a key driver. Standard menu items—burgers, sandwiches, salads—depend on everyday commodities whose market prices can swing with season and supply. When poultry, beef, or fresh produce becomes more expensive, the cost of assembling large catering trays rises in step.

2. Labor Costs

Wages and related labor expenditures also matter. Preparing bulk orders, packaging them securely, and coordinating timely drop-offs all require staff hours. Any upward pressure on local wage rates or benefits quickly feeds into the final per-head price quoted to offices.

3. Competitive Pressure

The corporate catering space is crowded. Providers watch one another closely, adjusting quotes to win contracts without eroding margins. A chain that can streamline back-of-house tasks may trim its offer slightly, nudging rivals to revisit their own figures.

4. Brand Positioning

Quick-service brands trade on speed, predictability, and value. Catering menus are priced to reinforce that identity, keeping the daily cost per employee low enough to fit tight facility-management budgets.

Implications for Businesses

1. Budget-Friendly Solutions

Ready-to-serve meal boxes allow firms to feed teams at short notice without stretching the purse. Fixed per-person pricing simplifies forecasting, a plus for controllers watching every line item.

2. Uptick in Mealtime Morale

A reliable rotation of familiar favorites—plus the occasional limited-time offer—can brighten the lunch hour. When staff know a hot meal is guaranteed, satisfaction and onsite attendance often improve.

3. Subtle Brand Exposure

Logoed packaging in the break room keeps partner brands visible. Over time, that gentle repetition can reinforce positive associations among employees and visiting clients alike.

The Role of Major Chains in the Corporate Catering Market

1. Market Leadership

Thanks to scale and logistics expertise, leading quick-service companies command a sizable slice of office catering. Their national footprint and centralized ordering portals make it easy for procurement teams to book recurring lunch drops.

2. Menu Flexibility

Recognizing diverse dietary needs, many chains now bundle vegetarian, lower-sodium, or smaller-portion alternatives. Such tweaks help them bid for wellness-oriented contracts that once went to specialty providers.

2. Expansion into New Markets

Beyond traditional downtown towers, catering packages are now pitched to warehouses, call centers, and pop-up event sites. Each new setting strengthens the chain’s overall presence in business-to-business foodservice.

Future Trends and Challenges

1. Demand for Healthier Choices

As workplace wellness programs mature, clients request more salads, grain bowls, and fruit sides. Incorporating fresher produce can raise costs, forcing a careful balance between nutrition and affordability.

2. Technology Integration

Apps that track delivery windows, dietary tags, and real-time temperature logs are becoming standard. Providers that invest early in such tools may offset the expense through higher order volumes and reduced waste.

3. Regulatory Shifts

Updated labeling rules, allergen disclosures, or packaging-waste directives can ripple through operating costs. Staying compliant while keeping prices competitive will remain an ongoing exercise.

Conclusion

Competitively priced fast-food catering bundles have redefined what offices expect from a lunchtime partner. By marrying convenience with predictable spend, large chains have carved out a dominant role. Continued success will hinge on their ability to balance cost pressures, health trends, and tech-driven service upgrades while still delivering the value that first attracted corporate clients.

Recommendations and Future Research

To deepen insight into pricing dynamics across the sector, the following avenues merit attention:

1. Comparative Analysis

Map the per-head fees of major quick-service caterers against regional independents to pinpoint where scale advantages translate into savings.

2. Consumer Behavior Studies

Survey facility managers and employees to learn which attributes—price, variety, delivery reliability—carry the most weight when contracts are awarded.

3. Longitudinal Studies

Track menu prices, ingredient costs, and client satisfaction scores over several years to reveal how external shocks or policy changes propagate through the catering supply chain.

By pursuing these lines of inquiry, researchers and procurement teams can gain a clearer picture of how everyday meal prices shape the wider corporate foodservice arena.